Running a business means making decisions every day about growth, spending, hiring, and strategy. But how can you make confident choices without clear, accurate financial information? That’s where financial accounting services become not just helpful, but essential.

At Rising Financial Futures, we’ve seen firsthand how proper financial accounting transforms businesses. Whether you’re a small business owner in Arizona, a professional managing multiple revenue streams, or an entrepreneur building something new, understanding the key principles of financial accounting can be the difference between guessing and knowing.

What is Financial Accounting Services ?

Financial accounting services help businesses keep their financial records organized and accurate. They include tasks like tracking income and expenses, preparing financial statements, managing payroll, and supporting budgeting and planning. These services give business owners and professionals a clear understanding of their financial health, so they can make informed decisions, stay compliant, and plan for growth.

At Rising Financial Futures, our financial accounting solutions simplify your reporting, compliance, and tax preparation, giving you accuracy and peace of mind.

We handle the complexity of financial statements, general ledger management, and regulatory requirements so you can focus on what you do best: growing your business and serving your customers.

What’s Included in Professional Financial Accounting Services

Accurate Financial Records and Reporting

Accurate records are the foundation of sound decisions. Our professional accounting services ensure your income, expenses, and accounts are recorded consistently, giving you a clear financial view.

- Transaction accuracy: All income and expenses are correctly recorded and categorized.

- Clear financial statements: Profit & loss statements and balance sheets reflect true performance.

- Reliable data: Reports reduce errors, support compliance, and guide business decisions.

Consistent Bookkeeping Support

Effective accounting relies on strong bookkeeping. Our virtual bookkeeping services keep your financial records organized and up to date, reducing stress and confusion.

- Organized accounts: Bank and credit card accounts reconciled regularly.

- Current records: Numbers are always up to date for timely decisions.

- Simplified tax prep: Accurate books reduce last-minute corrections and stress.

Payroll, Compliance, and Financial Organization

Professional financial accounting services also include support for payroll tracking, contractor payments, and financial compliance, helping businesses avoid costly mistakes.

- Accurate payroll: Records and payments are properly tracked and documented.

- Compliance support: Reduce penalties and filing errors with organized processes.

- Streamlined systems: Well-structured records save time and administrative effort.

Financial Insight That Supports Growth

Accounting should do more than record past activity. Our services provide financial insight that helps businesses plan ahead and grow with confidence.

- Cash flow visibility: Track where money comes from and goes.

- Profitability analysis: Identify what’s working and areas for improvement.

- Strategic guidance: Turn financial data into actionable business insights.

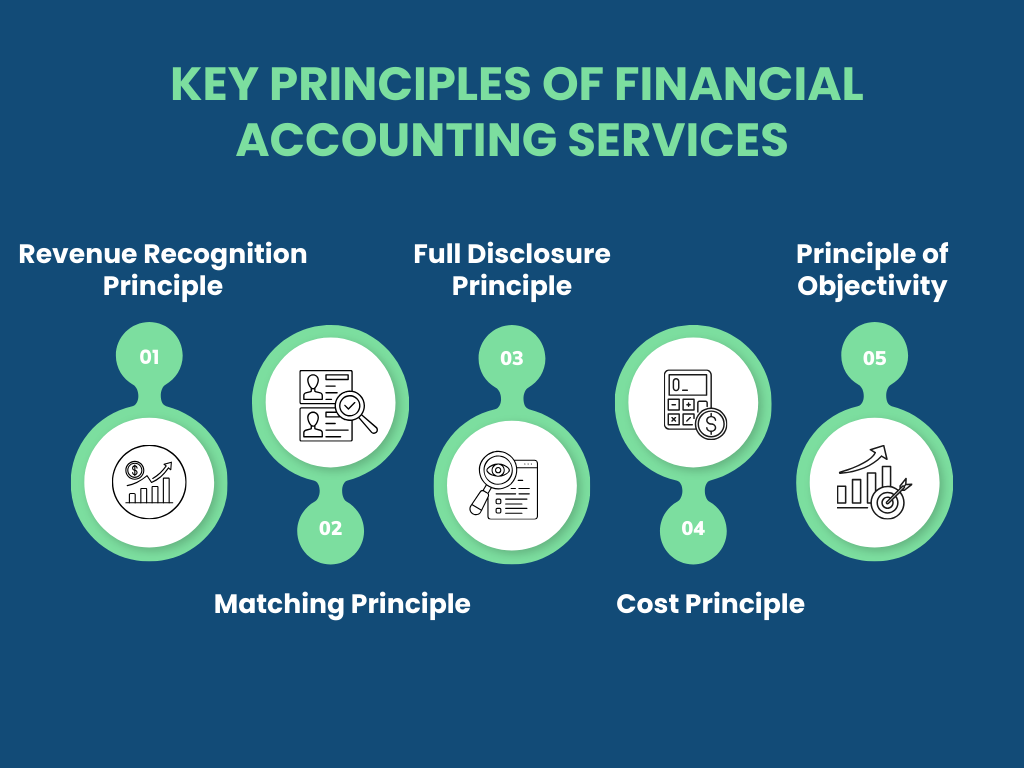

Key Principles of Financial Accounting Services

Strong financial accounting isn’t just about keeping numbers, it’s about following key principles that ensure your business’s financial information is accurate, reliable, and actionable. Understanding these principles helps small business owners, professionals, and entrepreneurs make better decisions, stay compliant, and plan for growth.

Here are the core principles we apply in our financial accounting services:

1. Revenue Recognition Principle

- What it is: Records income when it is earned, not necessarily when payment is received.

- Why it matters: Prevents misrepresentation of your revenue and ensures your profitability reports are accurate.

- Business impact: Helps you understand true performance, manage cash flow, and plan growth confidently.

2. Matching Principle

- What it is: Records income when it is earned, not necessarily when payment is received.

- Why it matters: Prevents misrepresentation of your revenue and ensures your profitability reports are accurate.

- Business impact: Helps you understand true performance, manage cash flow, and plan growth confidently.

3. Full Disclosure Principle

- What it is: Ensures all relevant financial information is reported in your statements.

- Why it matters: Keeps financial reporting transparent and credible.

- Business impact: Builds trust with investors, lenders, and stakeholders, and reduces compliance risk.

4. Cost Principle

- What it is: Records assets at their original purchase cost rather than estimated market value.

- Why it matters: Prevents overestimating assets and ensures financial statements remain realistic.

- Business impact: Provides a stable foundation for decision-making and long-term financial planning.

5. Principle of Objectivity

- What it is: Financial information should be based on verifiable evidence, not opinion or guesswork.

- Why it matters: Creates reliable, unbiased reports.

- Business impact: Enables confident decisions, supports growth, and strengthens credibility with partners and stakeholders.

Why This Matters For Your Business

Understanding the “what” is important, but the “why” is what drives growth. Here is why professional financial accounting services are a non-negotiable asset for your journey:

- Smarter Decision-Making – Real-time financial data helps you make confident choices about pricing, investments, and expansion opportunities.

- Tax Compliance & Savings – Professional accounting services for small businesses reduce audit risks while identifying legitimate tax deductions throughout the year.

- Sustainable Growth – Clear reporting reveals your most profitable products, services, and customer segments.

- Credibility with Investors – Well-prepared financial statements strengthen your position when seeking funding or forming partnerships.

- Time to Focus – Outsourcing to experts frees you to concentrate on serving customers and growing your business.

- Peace of Mind – Understanding your true financial position eliminates guesswork and stress.

Partner with Rising Financial Futures for Expert Financial Accounting Solutions

Strong financial systems give business owners the confidence to make better decisions and plan for sustainable growth.

At Rising Financial Futures, we provide professional accounting services in Arizona, offering financial accounting solutions, virtual bookkeeping services, and business consulting services tailored for small business owners, professionals, and entrepreneurs. Our financial accounting services are designed to simplify your finances, improve accuracy, and support smarter business decisions.

Let’s build a financial strategy that works for you, not against you.

Ready to gain the clarity you deserve? Contact Rising Financial Futures today and let’s start building your financial future.

Frequently Asked Questions

1. How do I know if my business needs professional financial accounting services?

If you struggle with messy books, unclear cash flow, tax stress, or missed opportunities for growth, professional financial accounting services can simplify your finances, improve accuracy, and provide actionable insights.

2. How can financial accounting services improve my cash flow?

By tracking income, expenses, and payments accurately, financial accounting services provide visibility into cash flow. This allows you to identify shortfalls, optimize spending, and plan for growth with confidence.

3. Can financial accounting services save me time as a business owner?

Absolutely. Outsourcing accounting and bookkeeping frees you from tedious financial management so you can focus on growing your business.

4. Do I need virtual accounting services if I already manage my books manually?

Virtual accounting services streamline bookkeeping, reporting, and compliance tasks. They save time, reduce errors, and provide professional insights that manual tracking often misses, freeing you to focus on running your business.

5. Can financial accounting services provide insights for business growth?

Absolutely. They analyze profitability, cash flow trends, and spending patterns to guide smarter business decisions.